What is the Second-best Bang-for-buck Control to Prevent Fraud at Your Company?

Human nature means your first question is “Wait, what is the best control to prevent fraud?”

It is a tip hotline.

43% of fraud schemes were detected by tips, and 33% of the tips were through tip hotlines and emails per the Association of Certified Fraud Examiners (ACFE) 2020 Report to the Nations. There are lots of providers of tip hotline services and they are relatively easy to implement. If you go with DIY tip hotline, make sure that people can access it (internal and external) and that people feel safe reporting. Due to these concerns in DIY tip hotlines and that third-party hotlines have become so cheap; we typically see companies go down the professionally managed hotline.

Since hotlines are a no-brainer, I am going to assume that you paused reading to set one up if you didn’t have one already and are back to learning what is the second-best control you can implement. The ACFE reviews 18 common key anti-fraud controls. Many of the contenders for second-best controls are for only larger companies or are a by-product of a specific environment and not a control in of itself. Read the full report here. The second-best control is based on:

- Broad applicability to small to large company (and not-for-profits).

- Ability to execute on a test basis for low cost and ability to scale up.

- Extra unintended benefits usually derived for operations from its existence.

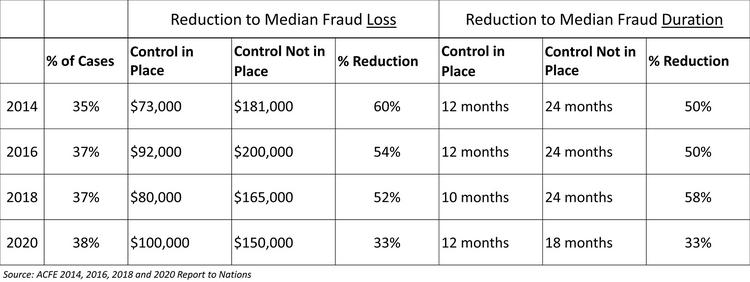

- It is a proactive data monitoring/analysis program.

The ACFE estimates that organizations lose 5% of revenue to fraud each year with an average loss of $1.5 million and a median loss of $125,000. When you start to quantify the costs of fraud, the fees for a data program (the software costs, professional fees, and/or opportunity costs for in-house staff time) become very reasonable and affordable. Plus, a proactive data monitoring program will usually lead to additional operational insights to the company that help provide additional value to defray the costs incurred of the program.

Rather, technology has improved and what were originally big detective tests have now been built into the software programs (that is how good they were that even some smaller business packages can integrate) and fraud is being prevented on the front-end (preventative controls) based on these.

Even if you are using a simple bookkeeping system and/or disparate systems you are sitting on a goldmine of data about your company.

Use it. Use it for fraud detection, improve business decisions, operational efficiencies, and the ultimate use: make your fraud detection program as a testing ground and put in more fraud prevention measures. What other fraud control do you know that can do all that?

This article was originally published on the Houston Business Journal website.