Payroll Taxes Deferral – August COVID-19 Update from PKF Texas

by PKF Texas | Aug 17, 2020

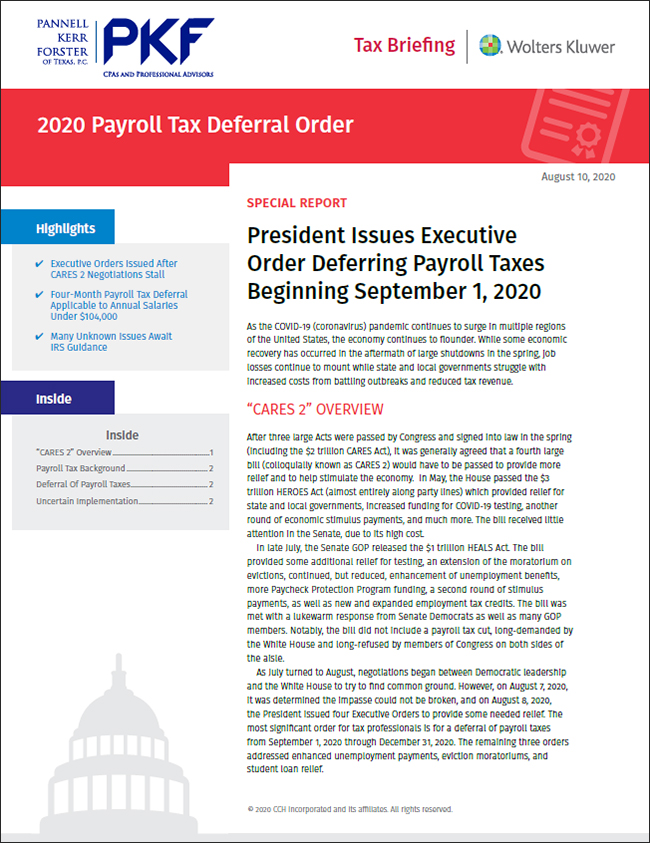

President Trump recently issued four Executive Orders related to providing added relief to businesses during the COVID-19 pandemic. The most significant order for tax professionals is for a deferral of payroll taxes from September 1, 2020 through December 31, 2020.

With this in mind, we want to share with you a special tax briefing which summarizes the following:

|

- “CARES 2” Overview

- Payroll Tax Background

- Deferral of Payroll Taxes

- Uncertain Implementation

|

|

The briefing may be downloaded here or by clicking the image above.

If you have questions about how the information in this briefing applies to your tax situation, please connect with your specific PKF Texas tax team members via email.

Additionally, we are keeping PKFTexas.com/COVID-19 up-to-date with information and resources to assist you as we all navigate these quickly-changing times.