Information on the 2010 Tax Relief Act

As a friend of our firm, we are committed to providing you with information on tax legislation that may have an impact on you and your business. Maybe this wasn’t first on your Holiday Wish List, but the December 17th signing of this tax legislation by President Obama could put some extra "jingle" in your pocket in the New Year.

Our tax team has outlined several business and individual income tax provisions contained in this legislation that we believe are most impactful to the friends of our firm. See the extended entry below.

As always, our dedicated team of tax professionals stand ready to assist, should you have any questions about how the provisions of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (referred to as the "Tax Relief Act") will specifically affect your business or household.

If you would like to connect to one of our tax professionals to discuss this and other tax planning matters, please visit www.www.pkftexas.com/taxnews.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

Business Legislation Items

Bonus Depreciation

Possibly one of the most favorable pieces of this legislation is the increase in bonus depreciation from 50% to 100% for new, qualifying property purchased after September 9, 2010 and before December 31, 2011 (property must be placed in service no later than 2012). Bonus depreciation is available to all taxpayers. For taxpayers who purchased capital expenditures in the last four months of 2010, this is clearly an unexpected benefit and could significantly reduce your projected tax liability for the 2010 taxable year.

In lieu of deducting bonus depreciation, taxpayers may elect to accelerate refundable AMT and research credits for 2011 and 2012.

Section 179 Expensing

Previous legislation increased the limits for immediate expensing to $500,000 (with a $2 million maximum investment) for 2010 and 2011. The Tax Relief Act adjusts the 2012 limit for immediate expensing to $125,000 (instead of $25,000), and raises the maximum investment cap to $500,000 (instead of $200,000).

Research and Development Tax Credit

This credit had previously expired at the end of 2009. It has now been retroactively extended for two years through December 31, 2011.

Small Business Capital Gains

Previous legislation expanded the exclusion of gain from qualified business stock to 100% for stock acquired between September 27, 2010 and January 1, 2011. The Tax Relief Act now extends the 100% exclusion to stock acquired before January 1, 2012. This could be a significant factor to early stage investors currently evaluating start-up investment opportunities.

Work Opportunity Tax Credit (WOTC)

This credit, which encourages hiring from targeted groups, was set to expire August 31, 2011, but has now been extended to December 31, 2011.

Energy Incentives

Individual incentives set to expire at the end of 2010, have been extended (although reduced to 10% rather than 30%) through 2011. Business incentives for items such as alternative or biodiesel fuel have also been extended.

Individual Legislative Items

Individual Rates

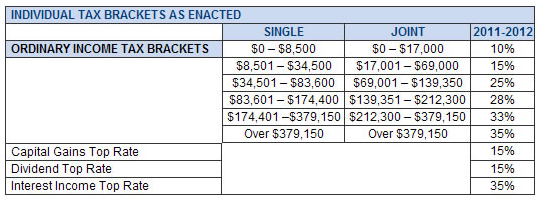

Individual rates were scheduled to increase to a top rate of 39.6% effective January 1, 2011. The Tax Relief Act now extends the reduced income tax rates through December 31, 2012, as shown below.

In 2013, high income individuals will also be subject to .9% additional Medicare Tax and net investment income will be subject to a 3.8% Medicare contribution tax.

Itemized Deductions

Itemized deductions will continue to not be subject to the 3% of AGI phase-out limitation through December 31, 2012.

Personal Exemption Phase Out

The Tax Relief Act extends the repeal of the personal exemption phase out through December 31, 2012.

Marriage Penalty

Marriage penalty relief is extended through December 31, 2012.

Payroll Tax Cut

The Tax Relief Act creates a payroll tax holiday which reduces the employee share of Social Security Tax (OASDI) from 6.2% to 4.2% for wages earned in calendar year 2011 up to $106,800. The provisions also reduce payroll taxes on self-employed individuals from 15.3% to 13.3%.

The change does not apply to the Medicare portion of the payroll and self employment taxes. Individuals earning in excess of the FICA cap of $106,800 for 2011 will receive a capped total tax of $2,136. Please note, this is an employee incentive only, as the employer’s share of OASDI will remain at 6.2%.

Child Tax Credit

The Child Tax Credit was scheduled to revert to $500 per qualifying child. The Tax Relief Act extends the $1,000 child tax credit for two additional years through December 31, 2012 (rather than reverting to $500/child). Please note that this credit phases out for taxpayer’s having AGI in excess of $110,000.

Adoption Credit

The Adoption Credit incentives are extended through December 31, 2012.

Dependent Care Credit

The Dependent Care Credit enhancements are extended through December 31, 2012.

Educational Programs

The American Opportunity Tax Credit (AOTC), previously known as the Hope Credit, of up to $2,500 for higher education expense, has been extended through December 31, 2012.

Contributions of up to $5,250 of employer provided education expenses can continue to be excluded from income and employment taxes through December 31, 2012.

Individual Extenders

Certain individual tax incentive extenders that had expired at the end of 2009 are now available through December 31, 2010:

- State and local sales tax deduction

- Higher education tuition deduction

- Teacher classroom expense deduction

- Charity contribution of IRA proceeds

- Charity contribution of appreciated property for conservation purposes

- Deduction for mortgage insurance premiums

However, the Tax Relief Act does not extend the additional standard deduction for real property taxes which expired in 2009.

Alternative Minimum Tax

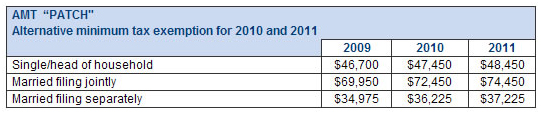

The Act (once again) provides a "patch" of the Alternative Minimum Tax (AMT) that will retroactively increase for 2010 and again increases for 2011 as follows:

Without the patch, which had expired at the end of 2009, an estimated 20 million taxpayers may have been subjected to AMT.

Employment Insurance

Unemployment insurance is extended for one year, and unemployed will get a 13 month deadline extension to file for benefits.

Estate and Gift Tax Provisions

The abolished 2010 estate tax was scheduled to return in 2011 at 55%. The Tax Relief Act reduces this estate tax rate to 35%, with a $5 million exclusion ($10 million for married couple) for descendents passing away between January 1, 2011 and December 31, 2012.