Using Balanced Score Cards for Your Business

Byron: Hi my name is Byron Herbert, and this is another Tool Time update brought to you by your friends at PKF Texas and the Entrepreneur’s Playbook. Today what I want to talk to you about is using a balanced score care in your business, and why you would want to use it. A balanced score card is just that, it’s balanced in that you can’t take performance from one area to offset another. To be a high performance organization there’s certain areas you need to perform well all the time, and so we’re going to talk about that, and what we do to build a balanced score card.

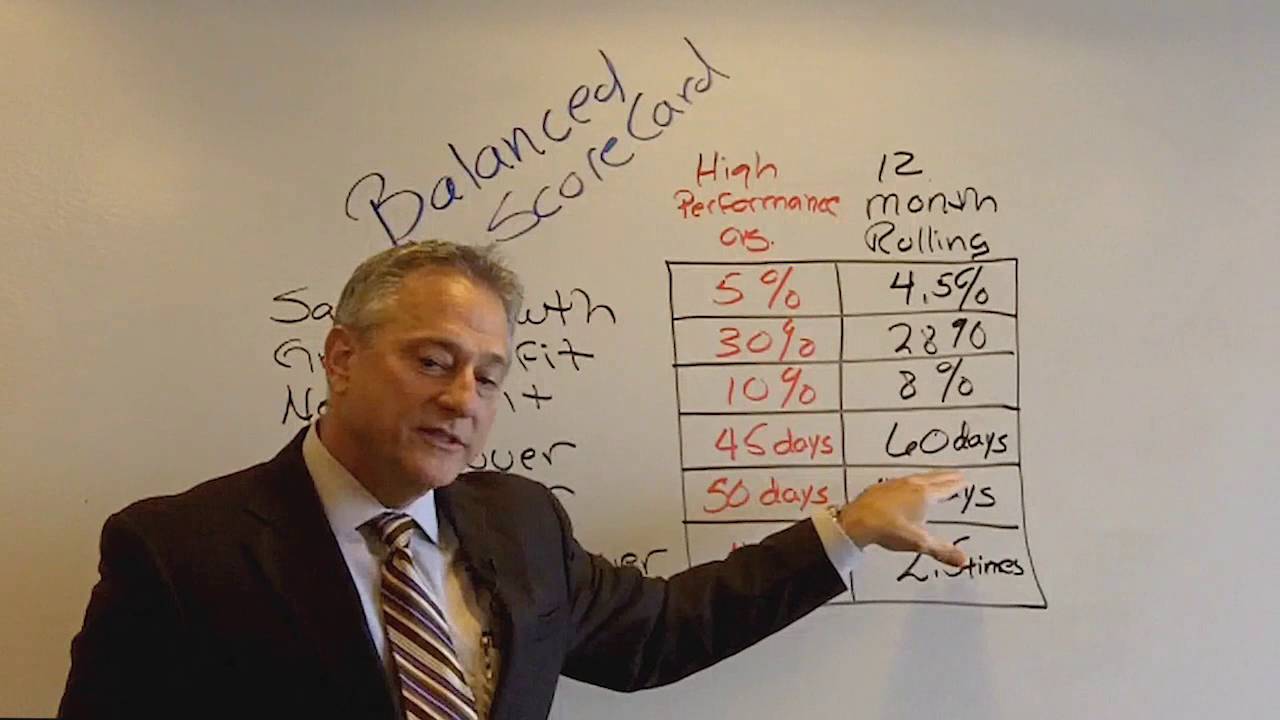

First we want to look at what a high-performance organization does. A high-performance organization in your industry, there’s a lot of information out there. We can find that. We can get that for you, and we want to compare ourselves not to the average, but for the high-performance organizations. So in this example I’ve given you, we’re looking a sales growth, gross profit, net profit, accounts receivable turnover, accounts payable turnover, and inventory turnover. So in our example, we’re looking at the 12 month rolling average for a company. So regardless of the month, we’re looking at the prior 12 months performance.

So we say sale’s growth. In our example here, a high-performance organization is operating at 5 percent growth ever year. Our organization is at 4.5 percent sales growth. Not bad, so we’re not going to be too worried about that one. Gross profit, a high-performance organization that’s operating at 30 percent, we’re operating at 28 percent. That’s okay too. Net profit, high-performance organization 10 percent, we’re at 8 percent. Again, we’re not worried about that. Our accounts receivable turnover, high-performance organization is running 45 days, we’re running 60 days. That’s 15 days over the high-performance organization. Fifteen days sales in your organization could be a lot of money you could drop to the bottom line in cash flow if you can improve that accounts receivable turn over. So we want to look at that. We’re going to track that, and maybe implement some policies to get that accounts receivable turnover down.

Accounts payable turnover, a high-performance organization did 50 days, we’re running 40 days, and so again we’re paying our bills a little quick, and maybe helping us on cash flow if we can extend that out another 10 days. So we’re going to look at that. We’re going to highlight that in red, and we’re going to look at it. Our inventory turnover, high-performance organizations in our industry are at four times, we’re at two times. So we’re not turning over our inventory quite as much. We’re building up inventory, which you’re probably using debt to do, and so that’s an area that we want to look at as well. We want to get our turnovers up to that four times, and get out cash flowing line.

So again, a balanced score card, comparing yourself to a high-performance organization using a 12 month rolling average, and highlighting in those areas where you’re not performing like your peers in high-performance organizations. This is Byron Herbert. This has been a Tool Time update brought to you by your friends at PKF Texas and the Entrepreneur’s Playbook.