Family philanthropy: Tips on private foundation vs. donor advised fund

Family philanthropic efforts can take many forms. Two of the most common philanthropy vehicles used among the affluent are the private foundation (PF) and the donor advised fund (DAF).

A private foundation is an IRC Section 501(c)(3) organization that has one primary source of funds, typically either from an individual/ family but may also be a business. This discussion focuses on private non-operating foundations, otherwise known as grant-making foundations.

A donor advised fund (DAF) is a separately identified fund or account that is maintained and operated by an IRC Section 501(c)(3) organization (public charity). Once the donor contributes to the DAF, the managing organization legally controls the funds going forward. The donor only maintains advisory privileges with respect to amount and recipient of distributed funds.

There are several items to consider when determining which of these charitable vehicles is best suited for addressing the donor’s situation and philanthropic goals.

Formation

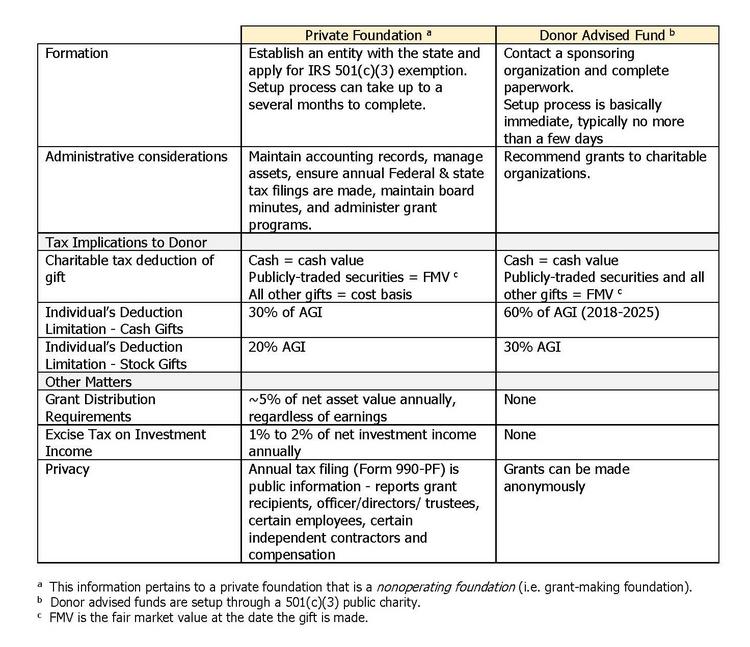

The timeframe involved and formation costs of creating these respective charitable vehicles varies dramatically. There clearly is more time and cost associated with establishing a private foundation verses a donor advised fund.

With the private foundation being a separate legal entity, there are definite costs associated with forming the entity. A private foundation must be legally created under state law. This typically requires the involvement of legal counsel for drafting the necessary formation documents and the payment of all required state filing fees. Once the entity is legally created under the state law, it must then prepare and file an application for exempt status (Form 1023) with the Internal Revenue Service. This step usually requires the services of a lawyer or CPA in order to properly complete the required paperwork. The formed entity isn’t an IRC Section 501(c)(3) private foundation until it receives its official approved designation (determination letter) from the IRS. Typically, the process of establishing a private foundation can take up to several months to complete.

In contrast, a donor advised fund is much easier to establish. The donor contacts a sponsoring organization (which already has a 501(c)(3) designation) and completes their required paperwork to initiate the creation of their donor advised fund. Contribution can usually then be received shortly thereafter. This is normally a much more expeditious process as compared to the formation of a private foundation. A DAF may only take a day or two to create and receive contributions, verses a PF, where it may take several months to be in the same position.

Administrative considerations

Once the charitable mechanism has been established, both a PF and a DAF require ongoing administrative functions to maintain the contributed funds. There are clearly less administrative responsibilities for the donor family with the DAF, as the managing charity handles most of the administration responsibilities. Private foundations clearly have ongoing administrative tasks, including maintaining accounting records, managing investment assets, ensuring annual federal and state tax filings are made, keeping board minutes, and administering their grant programs.

With a donor advised fund, the donor typically only makes grant recommendations to the sponsoring organization, who then acts on those recommendations. The responsibility to manage the investible funds typically rests with the sponsoring organization, not the donor family.

Tax implications to donor

Donations to a private foundation or to a donor advised fund are both tax deductible. However, the resulting tax deductibility to the donor family varies between these two.

The donation of cash and publicly-traded securities results in the same tax deduction for contributions to a private foundation and a donor advised fund. The tax deduction resulting from donated cash and publicly-traded securities is their fair market value (FMV) at the date of the gift.

The tax deduction resulting from closely-held stock donated to a DAF is also its fair market value at the date of the gift. Please note that typically an appraisal of some type is required to substantiate the FMV in such situations. However, the tax deduction resulting from donated closely-held stock to most private foundations is limited to only the donor’s cost basis.

An individual taxpayer’s charitable tax deduction limitations are also different between a PF and a DAF. An individual’s charitable deduction limitation on cash gifts to a private foundation is 30% of their adjusted gross income (AGI). This is in contrast to the 60% of AGI limitation for cash contributions to a donor advised fund. Furthermore, an individual’s charitable deduction limitation for gifts of publicly traded securities is 20% of AGI for contributions to a private foundation and 30% of AGI for contributions made to a donor advised fund.

Other matters

There are also tax considerations to be evaluated in the administration of these two charitable vehicles. Private foundations have certain annual distribution requirements and are liable for tax on annual investment income. The IRS requires that private foundations annually distribute 5% of net asset value, regardless of earnings. Failure to comply with this requirement results in an excise tax being imposed on the private foundation. Donor advised funds are not subject to this annual distribution requirement. In addition, private foundations are liable for a 1% – 2% excise tax on annual net investment income. This excise tax does not apply to donor advised funds.

Privacy concerns are another consideration in determining the appropriate charitable vehicle to achieve the family’s philanthropic desires. Donor advised funds lend themselves to more anonymity from the broader public. Private foundations have an annual income tax filing requirement (Form 990-PF). This return is open to public inspection. Form 990-PF return filing contains various information about the donor and his/her contributions to the entity. DAFs file Form 990 which is also open to public inspection. However, the Form 990 doesn’t require donor information be disclosed. Further, grants can be made from a DAF without disclosing the donor.

Consider all factors

There are many factors to consider when determining which charitable vehicle is best suited for achieving the donor family’s desires. It is critical to contemplate all factors – philanthropic goals, administrative considerations, tax implications – before deciding which charitable vehicle is best suited to assist donor families in successfully fulfilling their philanthropic goals.

This article originally published on the Houston Business Journal.